(聯合新聞網 記者胡幼鳳/台北報導)

地球物理學博士毛河光和赫姆利博士,利用高壓讓「鑽石(新聞、網站)快速長大」的專利(新聞、網站)方法實驗,五月間在日本及美國公開發表了一顆十克拉的鑽石,震驚學術界和珠寶界。

顛覆對鑽石價值觀

過去號稱要百萬年才能結晶的昂貴鑽石,總是伴隨著美麗浪漫的傳說,彩鑽甚至被形容為與彩虹相伴的星星墜入凡塵。不過毛河光卻有點殺風景的說:「牛糞就可以做鑽石。」顛覆了一般人對鑽石的價值觀。

毛河光預言:「廿一世紀是鑽石的年代!廿世紀最重要的發明是電腦,廿一世紀最重要的發明是會長大的鑽石!有一天,價廉物美的鑽石會取代矽在半導體的角色,矽谷會變成鑽石谷,將使人類科技進入另一世界。」

無色透明 技術大躍進

猶如古代點石成金的術士般帶動風潮,當三年前他們公開發表CVD鑽石的研究申請專利後,全世界有百家實驗室一窩蜂投入這種CVD(Chemical Vapor Deposition化學氣象沈澱)鑽石研發,但因無法突破鑽石生長的速度,後來紛紛退出,毛河光等人則是耗費百萬美元不斷實驗,終於發現了鑽石迅速長大的秘方。

今年五月他們先在日本舉辦的第十屆國際新鑽石科技會議發表了一顆十克拉、透明無色的CVD鑽石,接著以”Very Large Diamonds Produced Very Fast”「大鑽石量產快」的標題,在美國的實用鑽石會議上發表,媒體立刻大幅報導,因為過去研究以CVD方法長出來的鑽石,普遍帶棕、黃色,無法做高級珠寶,且做三克拉都很難,但他們卻大突破做到十克拉無色的透明鑽石,等於是CVD鑽石的大躍進。

九月間他來自台灣的學生顏志學博士將一顆二克拉的鑽石,在華盛頓拿給一位具有GIA美國寶石學院珠寶鑑定資格的專家鑑定,那名專家研究了半天,好奇地問他鑽石是從哪兒來的,因為那帶有稀有的粉紅閃光,而切割的方式也很特別,專家語帶保守的估計「應該要廿萬美金吧!」

鑑定專家 張口結舌

顏志學得意的告訴他這是顆CVD鑽石,讓跌破眼鏡的專家張口結舌,忙追問他們大概成本多少,他隨口回答:「大概五千美元吧!」那位專家難掩內心的激動,原本拿著鑷子鉗著鑽石觀察,當下手劇烈的顫抖到握不住鑷子。

其實這顆鑽石直接的成本甚至不到五千美元,除了以一塊成色不錯、厚度五毫米的天然鑽裸石為母石外,他們利用高純度甲烷(可由牛糞或垃圾等物產生的沼氣)、加上氫、氮等氣體輔助,在微波爐中以高壓方式,讓甲烷中與鑽石一樣的碳分子不斷累積到鑽石原石上,鑽石就一層層增生,長高長厚了。

這顆兩克拉的粉紅鑽是經過一周「長」出來的,他們用實驗室的雷射光切割後,再花了一百美元,請師傅用基本的Brilliant cut,車成一顆上圓下尖的基本款鑽石。

這顆「長大」的鑽石,品質與天然鑽石幾無二致,肉眼難辨,震驚了珠寶業界。全球知名的寶石分級、鑑定機構GIA對此大感興趣,其研究部門的工程師一再連絡他們,希望了解這種鑽石的特性及鑑定方法。

連收藏最著名的溫斯頓藍鑽「希望之鑽」的華盛頓史密森協會,其礦物部門主管波斯特聞訊也好奇,特別跑到他們的實驗室演講。

大廠洽商投資量產

目前已有多個國際知名的鑽石大廠正在和他們洽商如何投資量產,一旦投資量產,將全面改變大家對鑽石的價值觀,並衝擊整個鑽石市場。

但毛河光卻說:「珠寶其實是鑽石最沒有價值的部分,它只是虛華的裝飾品,鑽石的價格都是人為炒作的,在我看來鑽石價格不該那麼貴,鑽石大量生產後,可以更平價,有更多元的功能,鑽石除了硬度最高,還是很好的導熱及切割、研磨的工具,未來可以在醫療上及電子元件上有很大的用途。」

他強調鑽石比矽好一千倍,未來可以取代矽在半導體裡的角色。「到時候矽就會成為恐龍(歷史名詞)了」。

雖然國內半導體公司的工程師目前對於這樣的說法,還覺得「不可思議,怎麼可能用昂貴的鑽石來取代矽?」但鑽石大量生產後變得平價,未來誰說不可能呢?科學的演進不就因為很多偉大的夢想嗎!

Synthetics Drive Revolution in Diamond Technology ( Reuters Jul 15, 2005 )

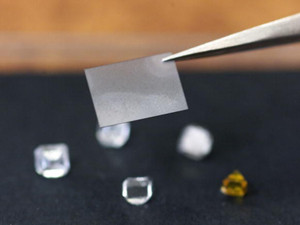

A wafer-thin Chemical Vapor Deposition (CVD) diamond is held by tweezers above ordinary artificial diamonds. (Toshifumi Kitamura/AFP/Getty Images)DAKAR - For centuries diamonds have lured women up the aisle; in future they may drive them to work as engineers find a use for the precious stones in electric cars and other applications.

From ultra-durable drill bits to semiconductors and optical instruments, industry officials say the uses for diamonds are multiplying and advances in synthetic production have opened the floodgates to ever more innovative applications.

”Diamond as a material is like what steel was in the 1850s and what silicon was in the 1980s. There will be lots of uses for it in the next 50 years but there is not enough of it in the ground,” said Bryant Linares, president and CEO of Massachusetts-based synthetic producer Apollo Diamond.

”We have the potential to make semiconductors which can be faster, and better, than any of the existing available semiconductors,” said Linares’ father Robert, chairman of the family-controlled business, speaking in a joint call to Reuters.

The durability of diamonds at high temperatures may revolutionize high-performance processors and could help make the electric car a reality for consumers around the world, he said.

”A lot of the problem with electric cars, power grids and even the computers of the future is dealing with the heat. The use of diamond rather than silicon can reduce the amount of circuitry by up to 80 percent,” he said.

Vapor

One of the major advances in synthetic diamond technology is chemical vapor deposition (CVD), which forms diamonds through a chemical reaction between gases.

CVD can be manipulated to make particular shapes of diamond much more effectively than the older ”high pressure, high temperature” (HPHT) method developed by General Electric in the mid-20th century which compresses carbon into diamond using molten metal as a catalyst.

That means wafer-thin layers of diamond can be produced for use in microprocessors, or thicker diamonds for other purposes.

The vast majority of diamond used in industrial processes around the world are synthetic. The Diamond Trading Company (DTC), the marketing arm of diamond giant De Beers, says some 200 tons of tiny synthetic diamonds, or grit, are used by industry each year -- several times total mined production.

With HPHT production, relatively few gem quality stones were produced, and most that were of yellow-brown color, sometimes known in the trade as ”canaries”.

But the CVD process gives the producer more control over the diamond produced and, vitally, can produce colorless stones.

De Beers, which controls around 55 percent of rough diamond sales by value, is also in the synthetic market through its Element Six subsidiary, the leading producer of synthetic diamonds for industrial use.

De Beers estimates the potential market for industrial diamond applications at $50 billion -- nearly as much as the $60 billion worldwide gem diamond jewelry sales and several times the $16.7 billion worth of diamonds in that jewelry.

In addition to its hi-tech products, Apollo has its eye on the gem market and believes CVD will eventually produce diamonds to compete openly in the market with mined stones.

”They are chemically, physically and optically identical to mined diamonds,” said Robert Linares. ”(But) we would prefer the fiancee to know she’s got an Apollo diamond.”

De Beers says synthetic production poses little threat to its market for traditional mined gems, quoting research showing that 94 percent of women want real -- not synthetic -- diamonds.

It has developed machines that can tell even colorless synthetic gem diamonds from the real thing, to prevent synthetic diamonds being passed off as mined gems.

”A diamond’s value is based on its inherent rarity,” DTC global marketing chief Stephen Lussier told Reuters. ”They are all as old as the world. The world has stopped making diamonds.”

文章定位: